The Benefits of Tax Planning in Investment Management

The Benefits of Tax Planning in Investment Management

Typically, in the last two quarters of the year, we tend to hone in on a variety of tax strategies for our clients. One of the ways we seek to maximize long-term growth is through tax-loss harvesting, in the form of selling investments that decreased in value inside of taxable accounts and reinvesting in asset classes that are most appropriate for that particular client. Without a basic level of understanding of the benefits of doing so, it may seem painful to see investments being sold at a loss. With that being said, what are the benefits?

Offsetting Capital Gains:

The primary benefit of tax-loss harvesting is to offset capital gains that are subject to taxation and use this as an opportunity to rebalance the account in such a way that aligns with the account owner(‘s) financial plan. For example, many accounts have seen substantial gains in the value of US Large-cap growth stocks (our primary growth fund is Vanguard’s growth ETF; VUG), and in contrast, have seen losses in their bond investments due to the current interest rate environment. By selling or realizing a portion of losses on the bond holdings, we are then able to sell a portion of growth stocks and reinvest both proceeds from each respective investment accordingly. This allows us to lower the tax bill on that particular account and provides for increased returns over the investor’s lifetime from the tax savings.

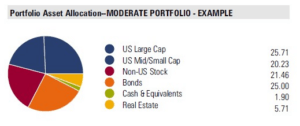

Reduce risk:

Aside from tax savings, reducing the risk of the portfolio is another advantage of tax-loss harvesting. A common example can be seen below, in which the current portfolio (bottom) has drifted from the original allocation to each asset class according to the model portfolio (top). The performance of each investment is reflected in the current portfolio, with the top performers now taking up a larger percentage of the portfolio’s allocation. This situation presents a convenient time to lower the exposure to US Large-cap stocks and re-allocate capital into a variety of fixed-income investments (bonds).

Increased returns:

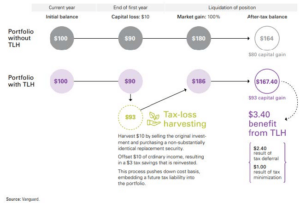

Tax Alpha: The excess return of a portfolio utilizing tax-loss harvesting over the return of the portfolio without harvesting losses.

As shown in the illustration below, an account actively harvesting investment losses benefits from tax deferral and overall tax minimization. A limitation of tax-loss harvesting is that there needs to be a sufficient amount of gains to fully maximize the benefits of this strategy. Without any gains in an account, a maximum of $3,000 of income can be offset by any realized losses, though any number of losses in excess of this amount can be carried forward to offset gains in future years.

Limitations:

While tax-loss harvesting is a time-tested strategy for many investors, there are many contributing factors that may limit an investor from enjoying these benefits. It should also be noted that tax strategies in investment management should always be considered, but should rarely guide the allocation of an investor’s total portfolio. “Don’t let the tax tail wag the investment dog.”

- Not every investor stands to benefit from tax-loss harvesting: The results of harvesting losses range from a net negative to gains of 1% or more depending on the investor’s situation.

- A net worth of ~$1.5m+ stands to gain the most: Households facing higher tax brackets now or in the future are able to minimize taxes paid over their lifetime to a greater extent than those in a lower bracket. That being said, taxes generally increase steadily as time passes, making it a more optimal time to pay taxes at today’s rates than gamble with future tax rates.

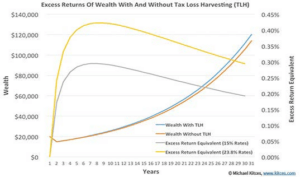

- Total benefits are marginal: Tax-loss harvesting is unlikely to provide soaring returns when compared to a portfolio not employing this strategy. Still, any excess return is worth exploiting in our opinion.

The graph above depicts the marginal benefit of wealth growth with and without tax-loss harvesting (TLH).

Conclusion:

Tax planning affords varying degrees of advantages to different investors, though it always warrants consideration in our opinion. If a situation arises when the pros outweigh the cons, clients can be sure we will pursue this strategy in their best interest.

In your service,

The McIlrath|Eck Team