Demystifying the Debt Ceiling

Cutting Through the Noise

Lately, there has been a lot of speculation surrounding the United States’ debt ceiling and the potential ramifications for capital markets. It should be noted that this is NOT an unprecedented discussion, and the consequences are well understood. However, the paths toward resolution are varied and far from certain. While a default is possible, in our view it is not the most likely result. Negotiations over budgetary concerns and future economic policies will continue to rage within Washington D.C. as we maintain a divided government, thus a short-term extension or suspension of the debt is a more probable outcome.

Understanding the Debt Ceiling

The debt ceiling, simply put, is the maximum amount of money that the United States government can borrow to meet its financial obligations. When the government hits this limit, it faces challenges in issuing new debt to fund its operations.

The government defaulting could lead to elevated bond yields, increased borrowing costs, a decline in consumer confidence, and possible turbulence in financial markets. Some investors may opt to hedge debt ceiling risks to their bond portfolio through investments in the U.S. dollar and gold. However, we believe that high-quality, diversified core bonds can provide protection if volatility intensifies. Even if this scenario does not play out, core fixed-income securities should still be well supported by slowing economic growth and inflation, which are likely to weigh on bond yields in the coming months. Ultimately, holding core bonds should reward investors with a higher yield.

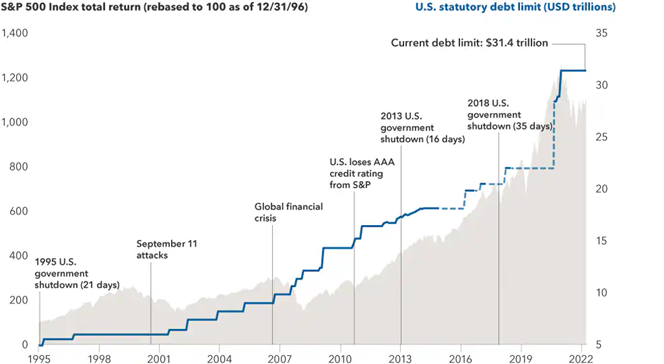

History of the U.S. Debt Ceiling

Source: Capital Group

Paths to Resolution

Traditionally the debt ceiling gets raised through legislation passed by U.S. Congress. Lawmakers introduce and debate a bill to either suspend or raise the debt ceiling, allowing the government to borrow additional funds to meet its financial obligations. This legislation must first be approved by both the House of Representatives and the Senate, after which the President must sign the bill into law. This process requires political consensus and cooperation among the branches of government. This latest bill, introduced by the Republicans, is not likely to be approved by the Democrats, including President Biden, as its primary focus is centered on reducing government spending.

Some policymakers are considering alternative approaches to address the debt ceiling issue. One potential option involves invoking the 14th Amendment, which asserts that the legitimacy of U.S. debt should not be questioned. However, this option is open to legal interpretation and could become entangled in the judicial system. Another possibility is to prioritize debt payments, although it remains uncertain whether the existing systems and procedures are capable of handling this effectively. The last legitimate route to consider involves allowing the Treasury to mint and deposit a trillion-dollar coin at the Federal Reserve in exchange for funds from the TGA (Treasury General Account). However, this suggestion has largely been disregarded by central bankers. Consequently, the most straightforward course of action is to suspend or raise the debt ceiling, avoiding unnecessary complications.

Potential Impact and Staying the Course

The cycle of fearmongering from the news may lead some to panic, but we must understand the difference between the U.S.’ current scenario and something much worse, such as an Argentina-style default, where investors lost their savings. We do not seriously believe that such an extreme outcome will occur. As of now the U.S. continues to retain its status as the world’s reserve currency.

While breaching the debt ceiling could have consequences, it’s essential to note that the United States has never defaulted on its debt obligations. The government has always taken steps to avoid such a scenario, and we expect them to do the same again. In fact, the government has raised the debt ceiling over 100 times since WWII, and under every president since 1959. However, how much longer this can continue is tied to the sustained confidence in the American economy.

By remaining committed to an established set of long-term goals and adhering to a disciplined investment strategy, investors can effectively navigate the potential default and maintain control over their financial future.

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. Diversification does not eliminate the risk of market loss.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services